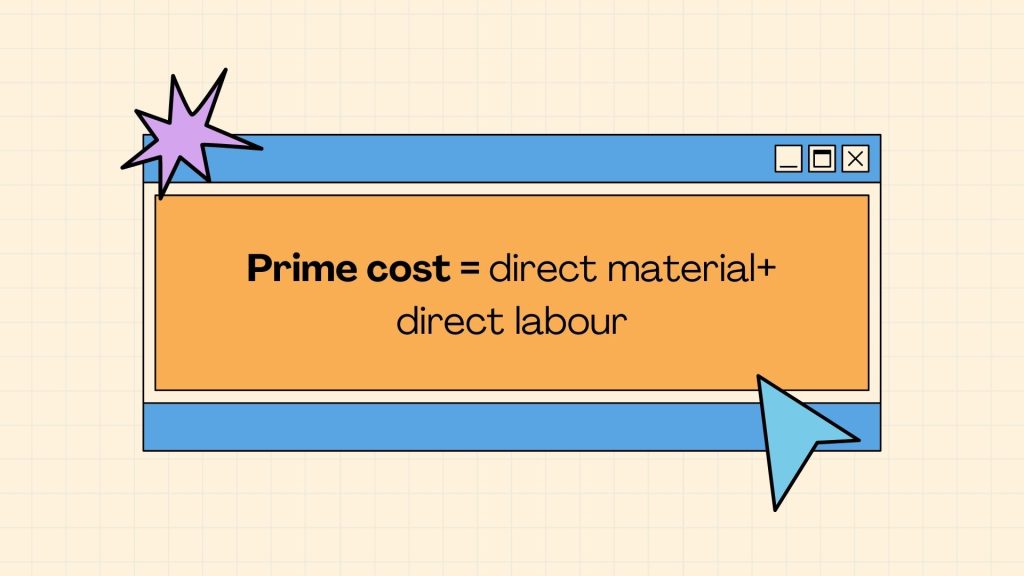

Prime cost method depreciation formula

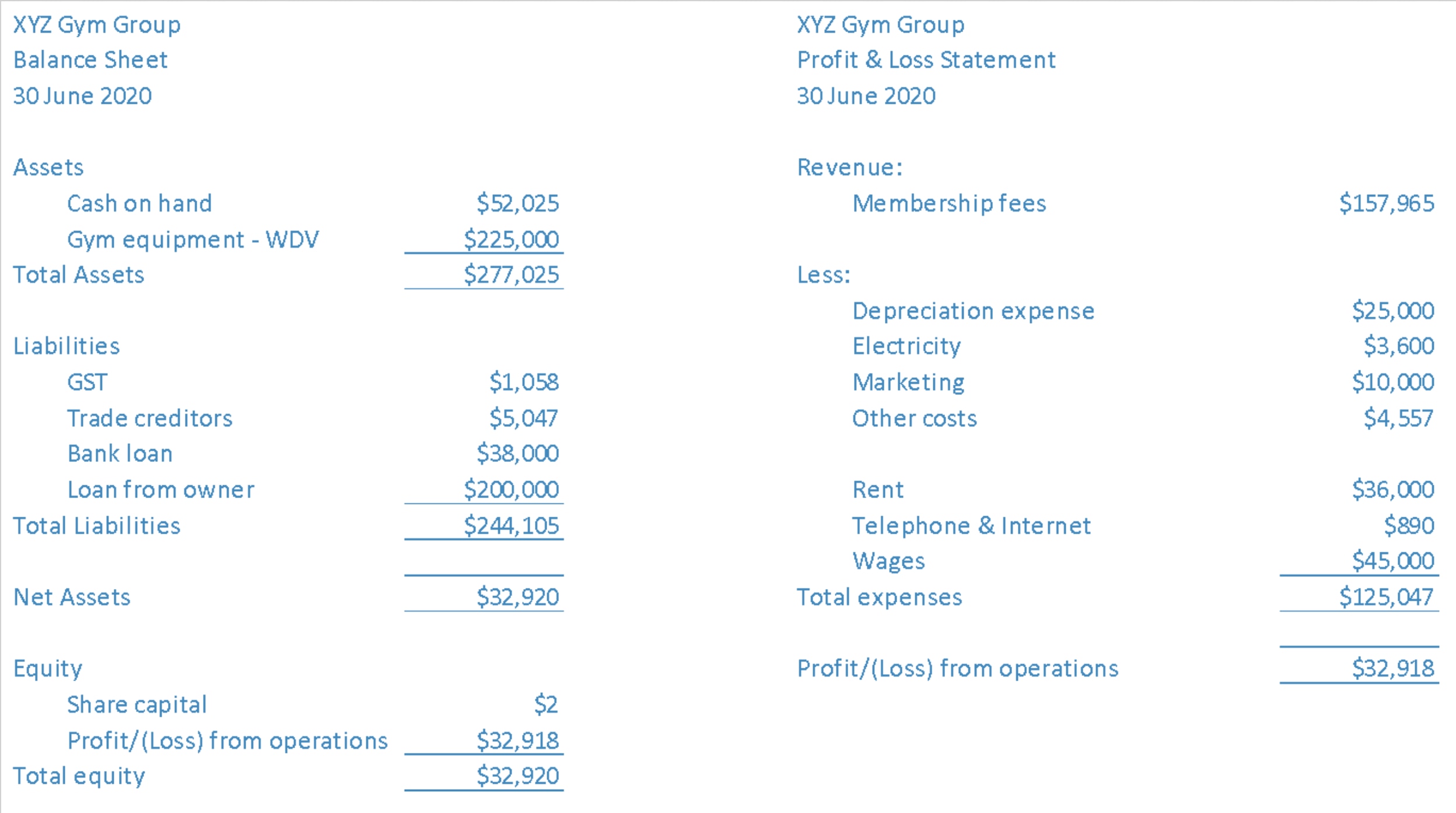

Depreciation x Actual output during the year units Sum of Years of Digits method It is a variant of the diminishing balance method. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula.

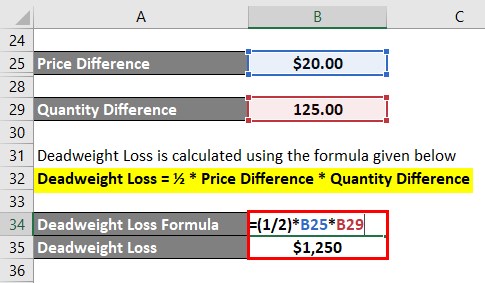

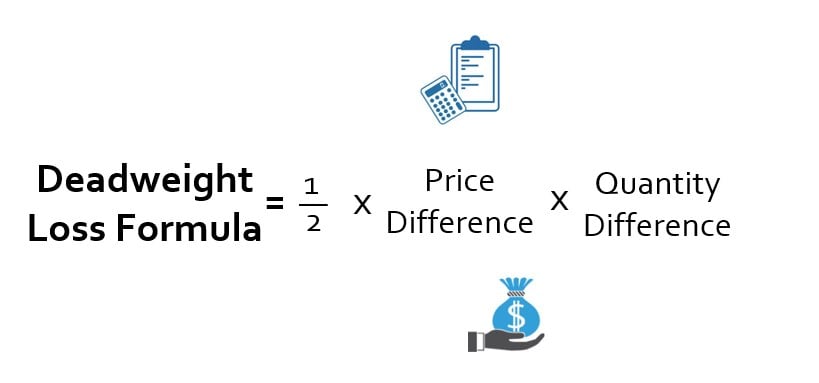

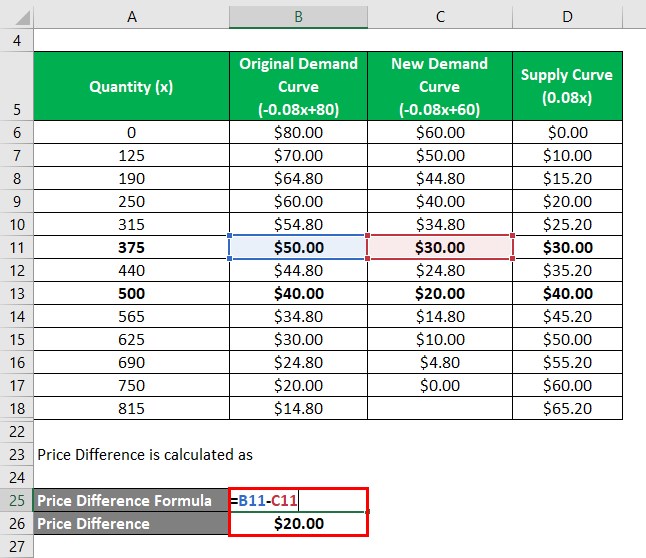

Deadweight Loss Formula How To Calculate Deadweight Loss

Assets cost days held365.

. Depreciation is calculated using the formula given below Depreciation Asset Cost Residual Value Life-Time Production Units Produced For Year 1 Depreciation 350 million. The following is the prime cost. Opening un-deducted cost days owned 365 100 assets effective life in years.

Prime Cost Method Formula to calculate the decline in value under the prime cost from LAW MISC at Western Sydney University. Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following. Here is the step by step approach for calculating Depreciation expense in the first method.

Assets cost days held 365 100 assets. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life.

Business vehicle depreciation is a Prime cost. If the cost of an asset is 50000 with an effective life of 10. The formula for calculating depreciation using the prime cost method is as follows.

The prime cost depreciation technique often known as the simple depreciation method determines commercial depreciation schedules of assets. To generate a profit the tables price should be set above its prime cost. Under the prime cost method also known as the straight line method you depreciate a fixed amount each year based on the following formula.

Depreciation Original cost Residual Value x frac. The prime cost to produce the table is 350 200 for the raw materials 150 in direct labor. This is the cost of the fixed asset.

This method assumes the life of a vehicle in order to calculate either prime cost or Calculating depreciation.

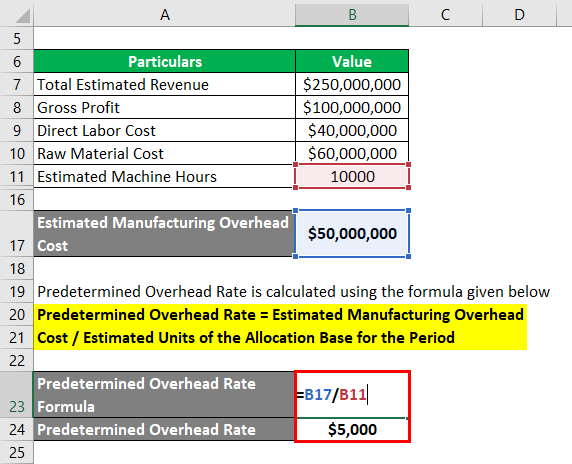

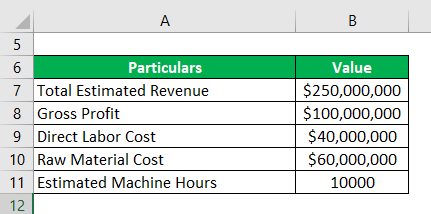

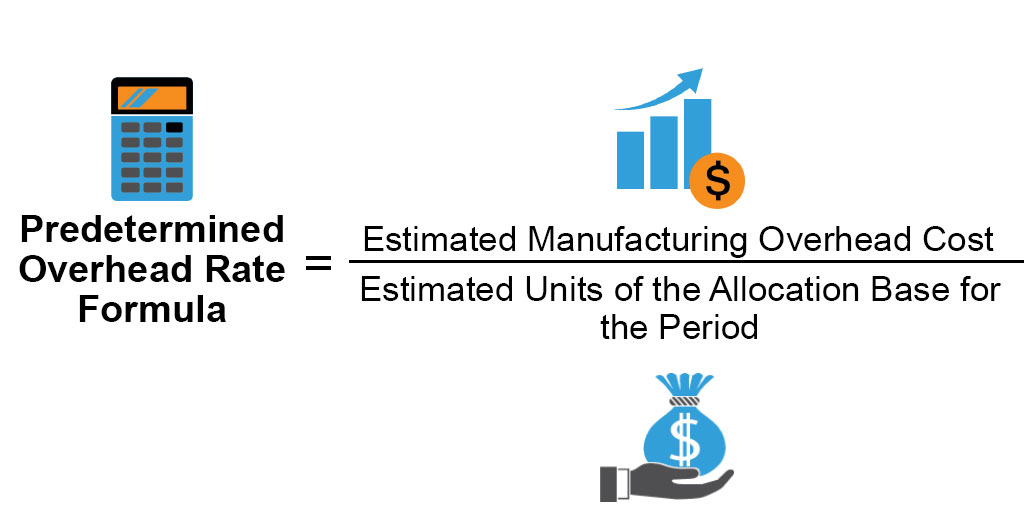

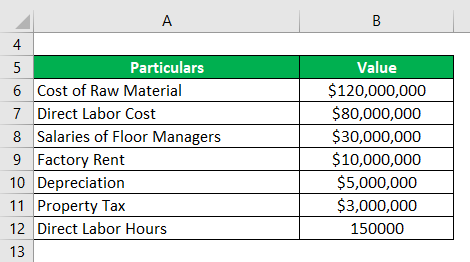

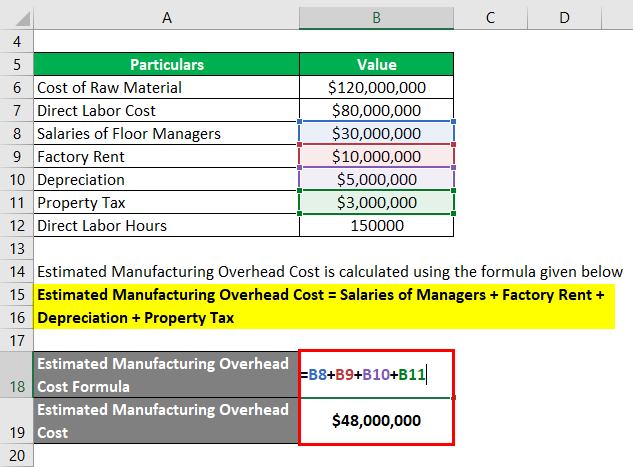

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

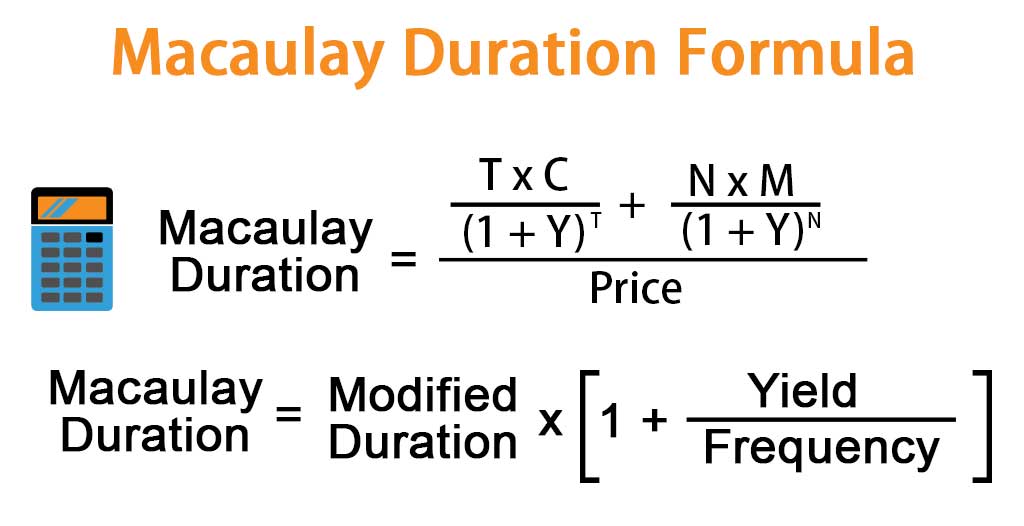

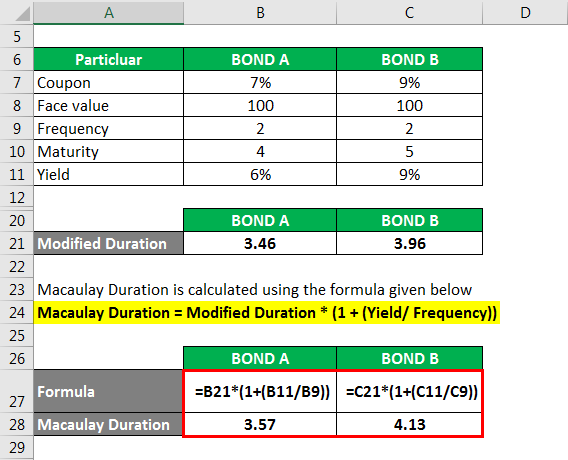

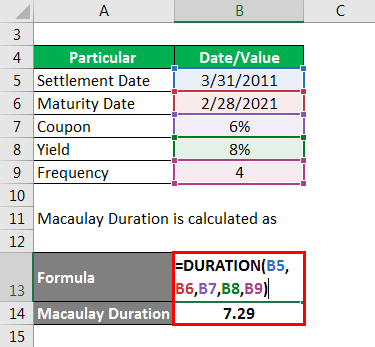

Macaulay Duration Formula Example With Excel Template

Deadweight Loss Formula How To Calculate Deadweight Loss

Macaulay Duration Formula Example With Excel Template

Accounting Vs Tax Depreciation Why Do Both Quickbooks

Sinking Fund Method Definition Functions Formula Benefits

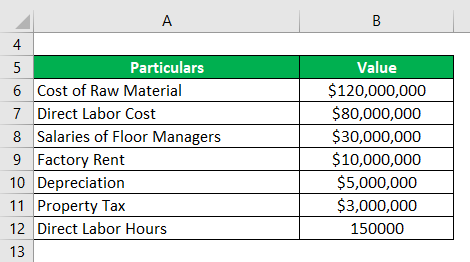

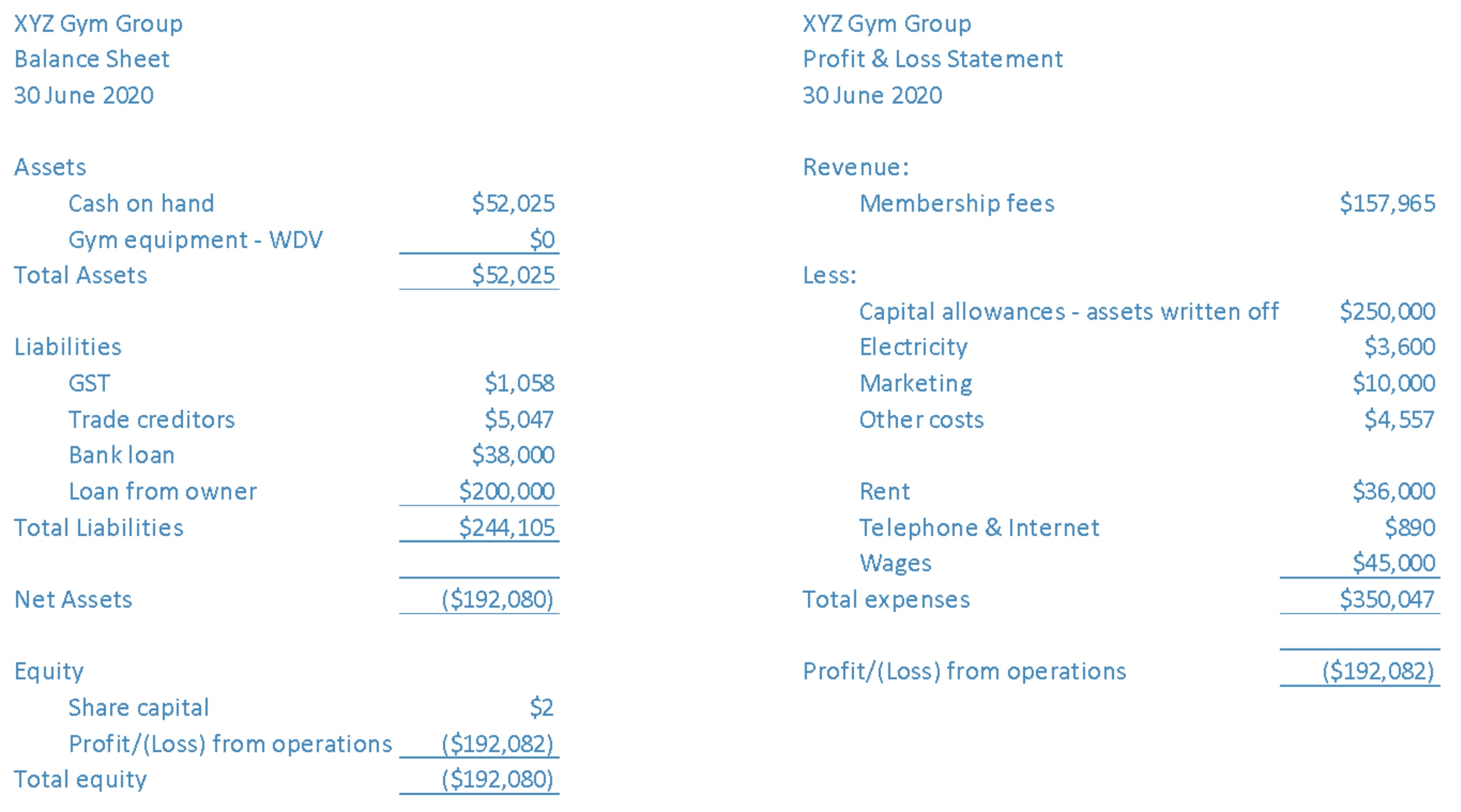

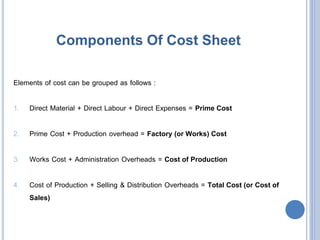

Costing

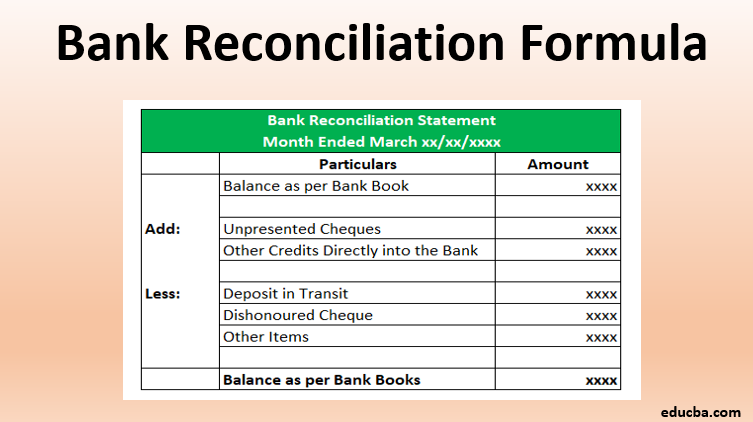

Bank Reconciliation Formula Examples With Excel Template

Macaulay Duration Formula Example With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Accounting Vs Tax Depreciation Why Do Both Quickbooks

Predetermined Overhead Rate Formula Calculator With Excel Template

Conversion Cost In Accounting

Deadweight Loss Formula How To Calculate Deadweight Loss

Predetermined Overhead Rate Formula Calculator With Excel Template

Units Of Production Method Financial Accounting